As a non-profit organization, have you found yourself struggling to keep up with compliance requirements while also managing your day-to-day operations?

Are you looking for an starter way to generate valid tax certificates for your donors? Look no further than ActiveDonor’s Section 18A tax certificate template.

A Section 18A tax certificate is a crucial document that allows donors to claim tax deductions for their contributions to registered Public Benefit Organisations (PBOs). By providing your donors with a compliant and accurate tax certificate, you can encourage continued support and strengthen your relationship with them.

We understand the challenges that non-profits face, which is why they have created an easy-to-use and customizable template designed to guide you through the process of generating a valid tax certificate. This template includes all the necessary fields and information required by SARS, ensuring compliance and accuracy.

How will this example Section 18A tax certificate template assist your non profit? Here are five key features that you will like:

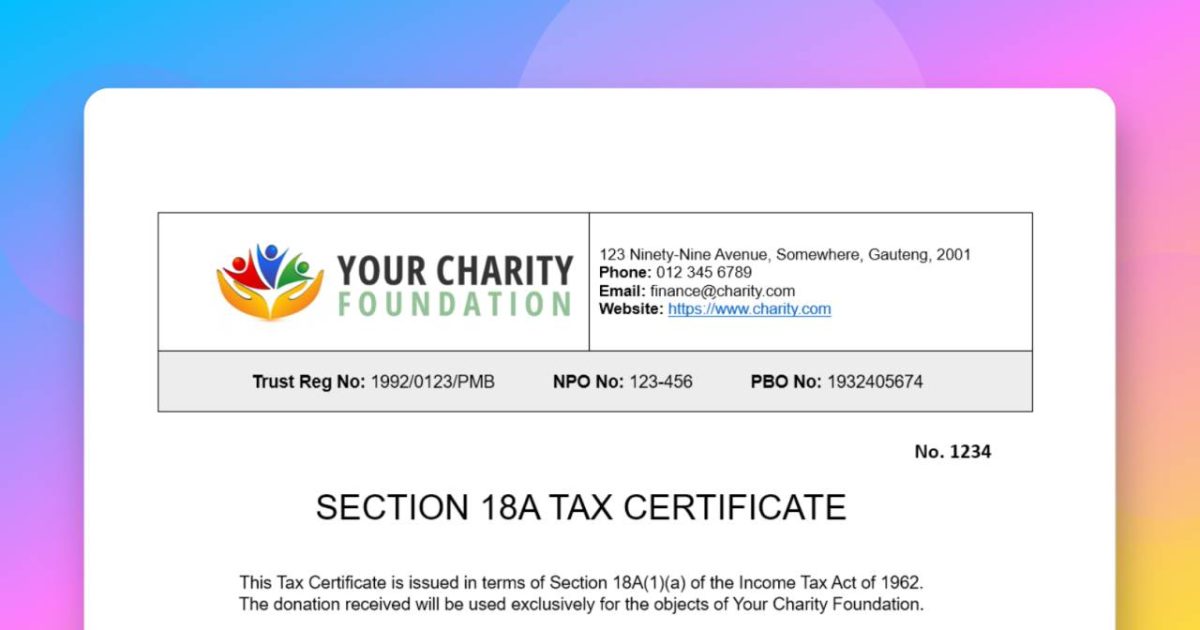

- Easy-to-Use Editable Format: The template is available in MS Word format and designed to be user-friendly and easy to navigate, allowing you to quickly and easily input the required information.

- SARS Compliance: The template includes all the necessary fields and information required by SARS, ensuring compliance with their regulations.

- Customization Options: The template is fully customizable, allowing you to add your own branding and tailor the certificate to your specific needs.

- Comprehensive Information: The template includes all the necessary information required for a valid tax certificate, including donor and donation details.

- Professional Appearance: The template is designed to look professional and polished, making a great impression on your donors.

Why Provide a free template? 🤔

We believe that all NPOs and NGOs, regardless of their size, should be able to comply with the Section 18A regulations without having to spend a lot of time and money on administrative tasks. Our free template will help small non-profits create a professional-looking Section 18A certificate that meets all the requirements and saves them time and resources.

Our free Section 18A template is just a small part of what we offer at ActiveDonor. We are a donor management and tracking software that provides advanced features such as automation, reporting, and CRM features. Our software is designed to help you manage your donor relationships, streamline their fundraising processes, and increase your impact. We also encourage you to consider trying out ActiveDonor for a free trial to streamline your fundraising efforts and increase your impact.

We are 110% committed to helping South African NPOs achieve their goals and make a difference in our communities! That’s why we’re offering our Section 18A tax certificate template for free. Don’t let compliance requirements hold you back from effectively managing your non-profit organization. Download the Section 18A certificate template today and take the first step towards ensuring compliance and strengthening your relationships with your donors.

We hope our template will make your life a little easier and help you strengthen your relationship with your donors.

WARNING: To legally issue Section 18A certificates, a nonprofit organization MUST be registered with the South African Revenue Service (SARS) as a Public Benefit Organisation (PBO) with Section 18A approval. Failure to obtain proper registration and approval before issuing these certificates may result in legal consequences and jeopardize the tax-deductible status of donations. Ensure your organization has met all SARS requirements before using this template.