Are you involved with charitable organizations in South Africa? If so, you may have come across the term “Section 18A certificate.” This document plays a crucial role in the tax-exempt status of donations made to qualifying organizations. Let’s delve into what Section 18A entails and what you need to know about obtaining and utilizing this certificate effectively.

Understanding Section 18A:

Section 18A of the Income Tax Act allows certain organizations in South Africa to issue tax certificates for donations received. These organizations, commonly known as Public Benefit Organizations (PBOs), include charities, public schools, and certain welfare organizations. Donations made to these PBOs may qualify for tax deductions by the donor, provided that the organization issues a valid Section 18A certificate.

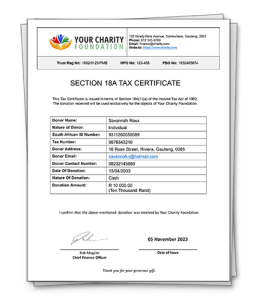

What’s Required on a Section 18A Certificate:

- Organization Details:

- Organization (PBO’s) Name

- PBO Number

- NPO Number

- Organization address

- Organization contact number

- Organisation email address

- Donor Type:

- Whether the donor is an Natural Person (Individual), Company, Trust, Estate, etc.

- Donor Information:

Natural Person (Individual) Donors:

-

- Donors Full Name

- Donor Identification Type and country of issue (ID/Passport)

- Donor Identification Number or Passport Number

- Income Tax Number

- Donor address

- Donor contact number

- Donor email address

Entity (Company/Trust/Estate, etc) Donors:

-

- Entity’s registered name (Company Name)

- Entity’s trading name (if different from registered name)

- Entity’s registration number (company registration number/trust number etc)

- Entity’s income tax number

- Entity’s address

- Entity’s contact number

- Entity’s email address

- Donation Details:

- Date of donation

- Nature of donation (cash, eft, goods in kind)

- Donation Amount

- Items that were donated – if goods in kind

- Declaration of Qualification:

- The certificate should explicitly state that the organization qualifies as a PBO under Section 18A of the Income Tax Act. This declaration assures donors that their contributions are eligible for tax benefits.

- Signature: An authorized signature is optional but recommended.

Important Notes about Section 18A:

- Donor Responsibility: Donors should ensure that they receive a valid Section 18A certificate for their donations. This certificate serves as proof of their eligibility for tax deductions when filing their annual tax returns.

- Verification Process: Before claiming tax deductions, donors should verify that the PBO issuing the certificate is indeed registered and compliant with SARS regulations. This can be done through SARS’s online portal or by directly contacting the organization.

- Tax Filing: When filing their tax returns, donors should accurately report their donations and include the details provided on the Section 18A certificate. Failure to do so could result in delays or discrepancies in tax assessments.

- Record-Keeping: Both donors and PBOs should maintain accurate records of donations and certificates for auditing purposes. These records help ensure transparency and compliance with tax regulations.

- Section 18A Update: As of 2023, NPOs need to submit an IT3D submission of all section 18As issued for the financial year to SARS.

How does ActiveDonor help?

ActiveDonor streamlines the process of maintaining SARS compliance by keeping all your donor information, donation receipts, and Section 18A certificates in one centralized location. This platform ensures easy access to all relevant data, enhancing productivity by making it simple to capture and store donor information efficiently. With instant generation and issuance of donation receipts and fully compliant Section 18A certificates, you can meet all your compliance needs quickly. Moreover, ActiveDonor stays up-to-date with the latest SARS requirements, allowing you to focus on your core activities with confidence that your organization remains compliant at all times.