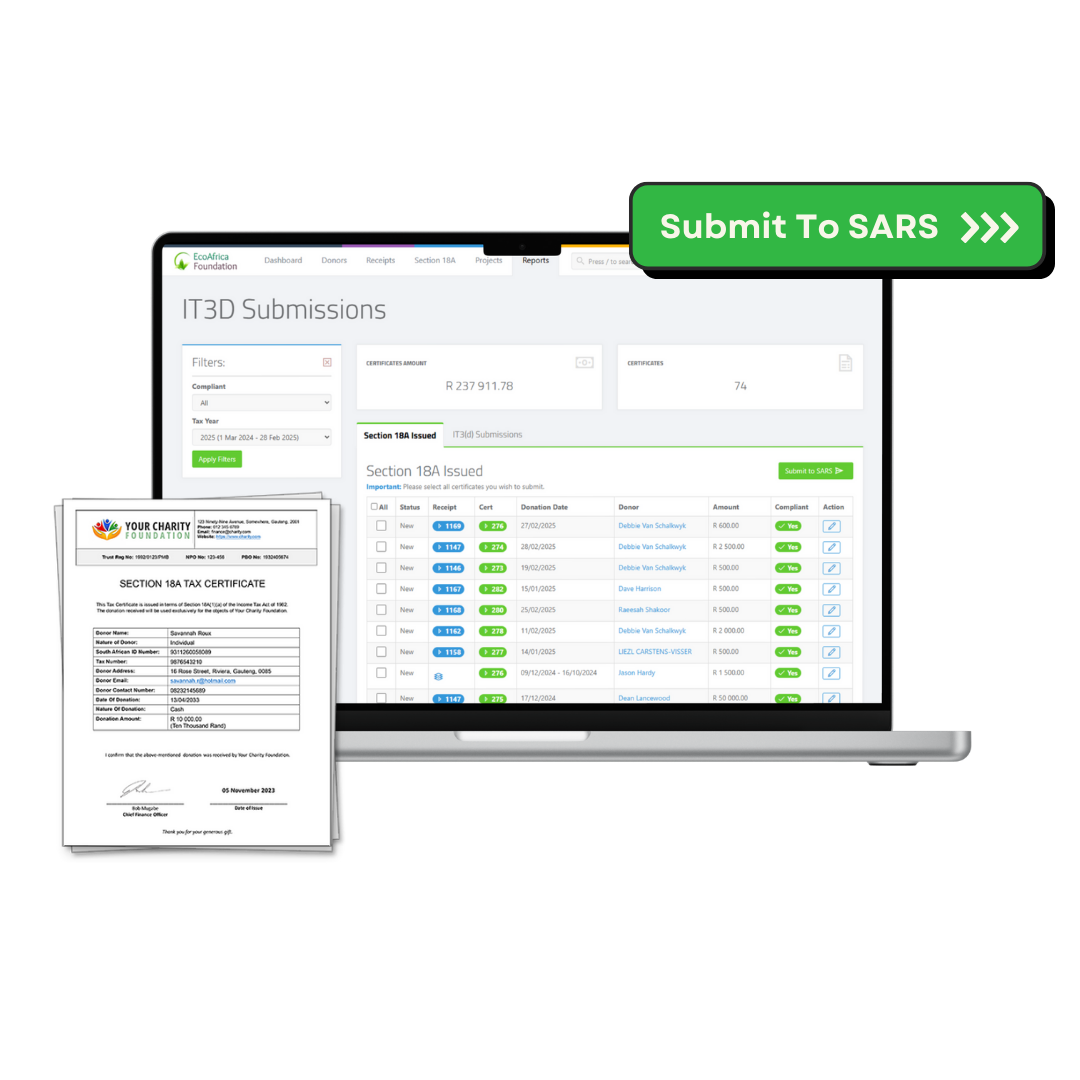

Are you tired of the time-consuming, error-prone process of manually preparing IT3(d) forms to SARS for your PBO’s Section 18A tax certificates? You’re not alone.

PBOs find it challenging to handle the submission process and ensure that data conversion is accurately done, especially those with limited resources or technical knowledge. They run the risk of making costly errors that may put their tax-exempt status and relationships with donors in danger.

That’s why we’re excited to introduce ActiveDonor’s new IT3(d) file submission service – the hassle-free way to prepare and submit your third-party data for upload to SARS.

• Automated data extraction from your donor database into the correct SARS file format

• Stringent data validation checks to minimize errors

• Time-saving and cost-effective solution

• Ensures compliance with SARS requirements for Section 18A tax certificates

By automating and streamlining this process, ActiveDonor helps public benefit organizations avoid costly mistakes, save valuable time and resources, and maintain good standing with SARS and donors. Their new IT3(d) file generation service takes the hassle out of this critical reporting requirement.